Dental implants are a modern solution to missing teeth. They mimic the look, feel, and function of natural teeth so you can smile confidently and comfortably. Unlike other alternatives such as dental bridges and dentures, tooth implants offer a more permanent and stable solution for a long-lasting, beautiful smile.

However, because of the advanced materials to be used and the complexity of the treatment, dental implants come with a significant cost. In Canada, a single dental implant can range from $3,000 – $5,000. Because of this steep price, many patients wonder if this can be covered by dental insurance.

Insurance coverage for implants ultimately depends on your type of insurance, provider, and your dentist’s evaluation. It is best to talk to your policy advisor and dentist so they can discuss your plan with you.

Overview of Dental Implants

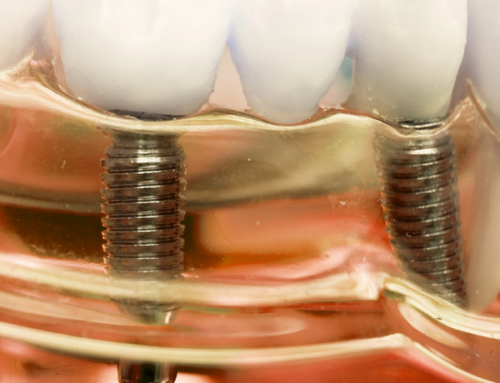

Dental implants are a versatile solution to lost or missing teeth. It can replace a single missing tooth or a full set of missing teeth. Generally, a typical dental implant has three main components:

- Titanium implant – serves as an artificial tooth root and is surgically embedded into the bone to support a future tooth replacement.

- Abutment – connects the titanium post to the artificial tooth.

- Tooth replacement – fills in the gap with missing or lost teeth. Depending on the number of missing teeth, this can be a dental crown, bridge, or denture.

Factors Influencing Dental Implant Cost

Dental implants involve a meticulous procedure that starts with a comprehensive assessment of your case. Because each case is different, the possible costs also differ for every patient. During your initial consultation, your dentist can explain the factors that influence the final cost of your implants, such as:

- Number of Implants – Generally, the more implants needed, the higher the overall cost.

- Additional Procedures – Some patients may require pre-treatments to prepare the mouth to receive the implants. This may include bone graft, sinus lift, or ridge expansion.

- Materials Used – Lastly, the material for the artificial tooth also greatly influences the cost. Higher costs are expected for premium materials such as all-porcelain or zirconia.

Types of Dental Insurance Coverage

Dental insurance is one of the many ways that you can opt to fund the cost of dental treatments. Depending on your plan coverage, this can include specific dental treatments ranging from basic and routine procedures to more advanced treatments.

In Canada, dental insurance can fall into three main categories:

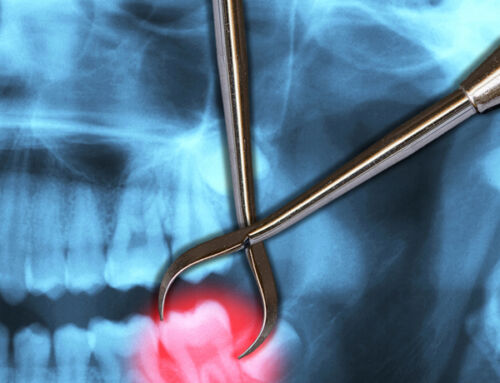

- Basic Dental Coverage: Routine and preventive dental procedures including dental consultation, cleanings, and X-rays fall under basic dental coverage. Some policies may also include simple tooth extraction and filling.

- Major Dental Coverage: Complex procedures such as crowns, bridges, dentures, and root canal treatment are classified under major dental coverage. This requires premium payments as it includes elaborate dental treatments. If within your policy scope, the crown of your dental implant can be covered by major dental coverage.

- Orthodontic Coverage: Dental procedures that target teeth alignment and bite problems, such as dental braces and orthodontic appliances, are classified under orthodontic coverage. Implants are rarely covered by orthodontic insurance policies unless there is a preliminary need for bite correction.

Private vs. Government-Funded Insurance

If eligible, Canadians may opt to be funded by the government for their dental treatments. This often targets low to middle income families or those who do not have private insurance. However, this is unlikely to cover implants. Most government-funded dental policies focus on essential or emergency dental services.

Otherwise, patients may choose to apply for private insurance. This offers a flexible option on coverage and limitations depending on the plan they choose. More premium payments generally offer better coverage for dental procedures. This may include dental implants, or part of its treatment, if within the scope of your chosen policy.

Are Dental Implants Usually Covered by Insurance?

Dental implants are not classified as a basic or emergency dental procedure. They fall under the elective or cosmetic category in most insurance policies, which is often not covered by dental plans.

However, depending on your plan details, partial coverage may be available. It is important to go over your insurance plan to understand where coverage is applicable. Here’s how some dental insurances can help cover the cost of your dental implants:

Consultation and preliminary procedures may be covered

Many dental insurance plans cover the cost of initial consultation for dental implants and the required diagnostic procedures, such as X-rays. This stage of the treatment is crucial to determine your eligibility for the treatment.

Crown placement may be classified under major coverage

If your insurance covers major dental procedures, your dental crown, which will be placed after the implant surgery, may be paid for by your insurance. This can significantly lessen the expected treatment cost.

Follow-up appointments can be covered under basic insurance plan

Post-surgical care and follow-up visits may also be covered if within the scope of your policy. This is essential in the long run as it helps your dentist identify early issues before they become serious problems.

How to Check if Your Insurance Covers Dental Implants

Some policies cover dental implants, whether partially or fully, while some do not. To avoid surprises, it is best to review your policy or ask your insurance provider before you undergo any dental treatment. Here’s a step-by-step guide on how to do this:

- Review your insurance policy – You should have a copy of your insurance policy with comprehensive information of your coverage. Go over this in detail to understand the inclusions and limitations of dental implants.

- Contact your provider – If you are still unsure, it is best to contact your insurance provider with specific questions about dental implant coverage.

- Determine a pre-treatment estimate – If you are determined to have some form of coverage for dental implants, the next step is to understand the expected fees for the procedure. You can ask your dentist for a pre-treatment estimate, then go over this with your policy coordinator to determine which of the costs will be covered.

- Understand possible costs – Once your coverage is applied and the costs are finalized, you can obtain a breakdown of your expenses and be prepared for out-of-pocket costs.

Get In Touch

Dental implants offer a reliable solution for missing teeth and are an excellent investment to your smile. However, the cost is a concern for many patients. And even with insurance, dental implants may not always be fully covered.

To ensure you make the most out of your insurance benefits, especially if you are looking to get dental implants, carefully review your policy, ask your provider, and work with your dentist to determine how to reduce the implant costs, if possible. While full coverage may not be possible, partial coverage can significantly lessen the cost and make dental implants a more accessible choice.